Renting or Buying Is Often Personal, but It’s Also Helpful to Look at the Numbers

Credit…The New York Times

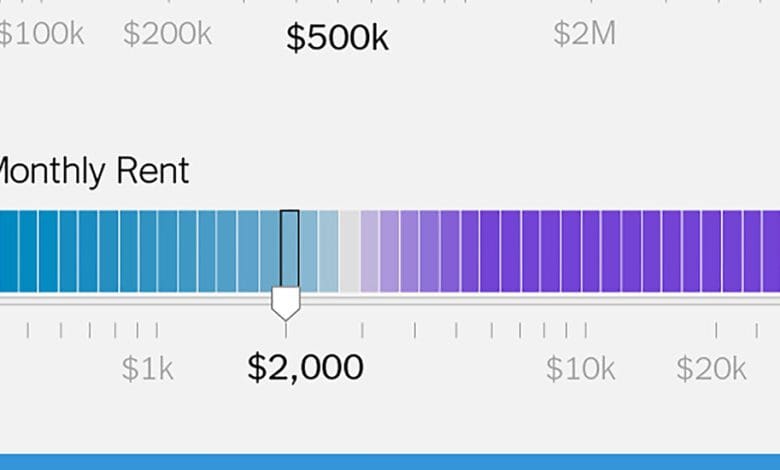

The Upshot last week updated one of its earliest and most popular projects: the Rent or Buy calculator. Its lasting popularity is no mystery: All of us make this decision at some point. But it may be even more relevant today, with a changed environment of higher interest rates, than it was when the Upshot was created a decade ago.

The new calculator takes into account the 2017 tax law that affected the mortgage-interest deduction and limited SALT deductions. Here are a couple of other points for longtime calculator fans and new readers alike:

-

One of the biggest factors in the rent-vs.-buy decision is something we can’t predict: the housing market. Because our math takes into account the full cycle of owning — buying, annual costs and then selling — home price appreciation can vastly change your results. The same house might look like a great financial decision at 8 percent housing value growth, and a bad one at 4 percent. If you’re serious about buying, toggle that slider around, look at the history of home price growth in your area over shorter and longer periods, and go into the process with a range of numbers in your head, not just one.

-

We fully understand this isn’t just a financial decision. You might want to own a home so that you can paint your walls or grow a garden or DIY to your heart’s content. You might want certainty that your children can stay in their school district. Or you might want to rent because it’s nice never to have to worry about repairs, big or small. Our calculator can’t take any of that into account, but you should.

Give the calculator a whirl here, and take note that you can now save and share your results.