Rents Are Flat — or Up, or Down, Depending Where You Look

On the national level, rental rates have flattened over the past year — which is good news following the head-spinning increases of 2022 into 2023. But as Zumper’s February rent report points out, how much a renter should expect to pay in 2024 is highly dependent on where they live, with a record amount of new inventory in Western and Southwestern regions offset by low-supplied markets in the Midwest and Northeast.

Smaller increases on renewal leases and stubbornly high mortgage rates have enticed more renters to stay put, easing competition among those looking for a place. The national rate for one-bedrooms fell 0.7 percent from February 2023 to February 2024. That may not sound like much, but it was just the second time in the past three years that the year-over-year change dipped into the negatives. Two-bedrooms increased by 0.7 percent.

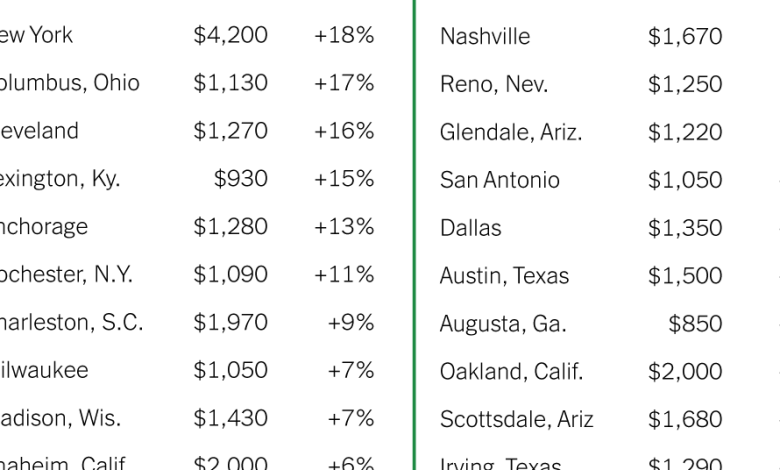

The report includes more than 1 million active listings in the 100 largest U.S. cities. Among these cities, rents for one-bedrooms fell in 57, were flat in 11, and rose in 32. The biggest drop was in Winston-Salem, N.C., where rents fell 19 percent over a year, followed closely by Greensboro, N.C., and Albuquerque.

A glut of new construction has helped stabilize the market overall, with most of the development happening in the Sun Belt and mountainous Western regions. Two extreme examples are playing out in Dallas and Austin, Texas, where a building boom has resulted in a 10 percent drop for one-bedroom rents. Landlords have also been offering incentives, such as free months of rent and waived fees, to get prospective tenants to sign on the dotted line.

Meanwhile, the opposite is happening in cities where supply remains low and demand high. One-bedroom rents were up 22 percent over a year in Syracuse, N.Y., and 21 percent in Chicago. New York was next with an 18 percent increase. Anchorage, Lexington, Ky., and Charleston, S.C., were also among the markets where increases were in or close to double digits.

For weekly email updates on residential real estate news, sign up here.