More Rentals Are on the Market. Why Are They So Hard to Find?

Last week in this space, we reported on the spate of new rental apartments that have landed on the U.S. market recently — more than 1.2 million over the past three years, mostly on the high end. But what has this meant for renters competing to find their next home? According to a new study by RentCafe, this year’s peak rental season (April through June) was in fact less competitive than last year’s, thanks in part to that increased inventory and to fewer prospective renters vying for each unit.

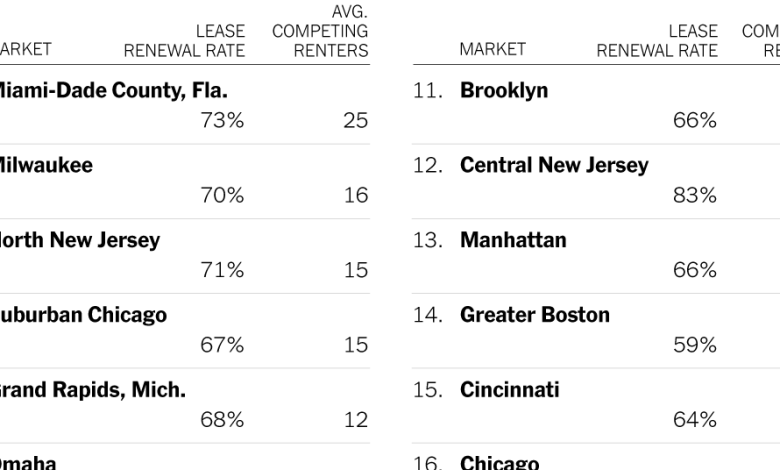

The study examined five metrics to rank 139 U.S. markets during peak season: occupancy rate, lease renewal rate, the average number of prospective renters for each unit, the average number of vacant days, and the share of new apartments added during peak season. Only market-rate rental buildings with at least 50 units were included in the analysis.

More than half the markets studied were less competitive than they were a year ago, when an average of 15 renters competed for each unit; this year it’s down to 10. Apartments are staying vacant longer, too, giving renters more time to search and consider.

Despite a slight decline in population, Florida’s Miami-Dade County was found to be the nation’s tightest rental market, with 25 renters battling for each available apartment. Even with a flurry of new development in the area, over 97 percent of apartments were occupied, and 73 percent of renters renewed their leases. Two other Florida markets, Orlando and Broward County, also were among the 10 most competitive.

The Midwest was the most competitive region, with more renters drawn by the relative affordability and expanding job market. In Milwaukee, 70 percent of apartment dwellers stayed put during peak rental season, pushing the occupancy rate to 96 percent. Suburban Chicago, Grand Rapids, Mich., and Omaha also landed in the top 10.

For weekly email updates on residential real estate news, sign up here.