As Natural Disasters Get Worse, So Do Home Insurance Premiums

As natural disasters wreak ever more havoc across the country, so are they upending the home-insurance industry, which is passing along the higher costs of home maintenance to policy holders.

According to a study by Policygenius, an online insurance marketplace, U.S. insurers paid out $99 billion in claims related to natural disasters in 2022. As a result, premiums rose by an average of 21 percent from May 2022 to May 2023, dwarfing the 12 percent increase during the previous year. The study examined more than 17,000 policies renewed with Policygenius across 46 states and Washington, D.C., omitting four states where adequate data wasn’t available.

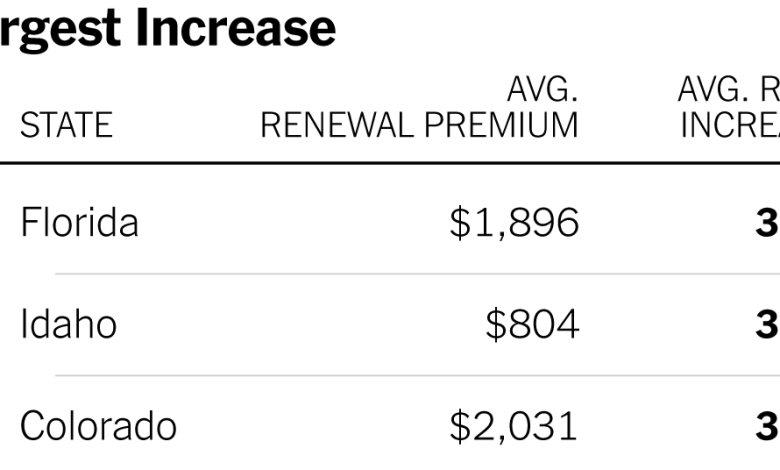

Rates increased by an average of 35 percent in Florida, the most of any state. Hurricane Ian, which hit in late September, turned out to be the costliest hurricane in the state’s history. In Idaho, where many homes are vulnerable to wildfires, owners paid an average of 31 percent more. Colorado, South Dakota, Louisiana and Texas also saw marked rate increases as residents confronted more losses from natural disasters and fewer insurance options. (East Coast states saw the smallest rate increases at renewal in 2023.)

Indeed, some insurers are cutting their losses. Over the summer, Farmers Insurance announced it would not renew about a third of its policies in Florida, while other insurers simply went out of business. In California, State Farm, the state’s largest insurer, stopped issuing new policies this spring. But as the need for insurance grows, rates will continue on their upward trajectory.

Also contributing to higher premiums: Inflation and supply-chain problems, which make repairs more expensive, and soaring home prices in general. This week’s charts shows the places where rates climbed the most and the least, according to the study.

For weekly email updates on residential real estate news, sign up here.