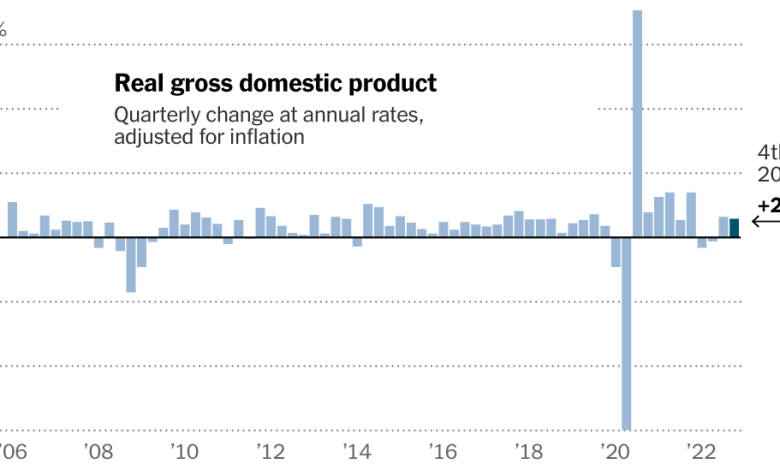

The U.S. economy grew at an annual rate of 2.9 percent in the fourth quarter.

Economic growth remained solid at the end of last year as the strong job market and cooling inflation allowed Americans to keep spending despite fears of a recession.

U.S. gross domestic product, adjusted for inflation, increased at an annual rate of 2.9 percent in the fourth quarter of 2022, the Commerce Department said Thursday. That was down slightly from a 3.2 percent growth rate in the third quarter. Consumer spending, the bedrock of the U.S. economy, grew at a 2.1 percent rate. The data is preliminary and will be revised at least twice in coming months.

“The economy continued to motor on,” said Michael Gapen, chief U.S. economist for Bank of America. “There’s more momentum in the economy at year-end than we thought, and a lot of that is from households.”

The healthy fourth-quarter growth capped a year in which economic output contracted in the first half, prompting talk of a recession, then rebounded. Over the year as a whole, as measured from the fourth quarter a year earlier, G.D.P. grew 1 percent, down sharply from 5.7 percent growth in 2021.

The seesaw pattern in 2022 was driven by big swings in trade and inventories, historically the most volatile components of G.D.P. The bigger picture, economists said, was simpler: The recovery from the pandemic recession has cooled from the frenetic pace of 2021, but has remained resilient in the face of war in Europe, inflation around the world and an aggressive series of interest-rate increases by the Federal Reserve at home.

Inflation F.A.Q.

What is inflation? Inflation is a loss of purchasing power over time, meaning your dollar will not go as far tomorrow as it did today. It is typically expressed as the annual change in prices for everyday goods and services such as food, furniture, apparel, transportation and toys.

What causes inflation? It can be the result of rising consumer demand. But inflation can also rise and fall based on developments that have little to do with economic conditions, such as limited oil production and supply chain problems.

Is inflation bad? It depends on the circumstances. Fast price increases spell trouble, but moderate price gains can lead to higher wages and job growth.

How does inflation affect the poor? Inflation can be especially hard to shoulder for poor households because they spend a bigger chunk of their budgets on necessities like food, housing and gas.

Can inflation affect the stock market? Rapid inflation typically spells trouble for stocks. Financial assets in general have historically fared badly during inflation booms, while tangible assets like houses have held their value better.

“2020 was the pandemic. 2021 was the bounce back from the pandemic. 2022 was a transition year,” said Jay Bryson, chief economist for Wells Fargo. “It will go in the history books as an OK year.”

The initial rebound from the pandemic recession was much stronger in the United States than in much of the rest of the world. The gap widened last year as the war in Ukraine threatened to push Europe into a recession and the strict Covid suppression policies in China constrained growth there.

The question now is whether the United States’ resilience can continue in 2023. Inflation remains too high by many measures, and the Fed is expected to continue increasing rates in an effort to bring prices under control. A congressional showdown over raising the debt ceiling could cause further turmoil in financial markets — or a crisis if lawmakers fail to reach a deal. Many forecasters still say a recession is likely, perhaps later this year.

Already, there are signs of strain, especially in the sectors most sensitive to higher borrowing costs. Construction activity and home sales have slowed significantly. Tech companies have announced tens of thousands of layoffs in recent weeks. Manufacturing output fell in November and December.

Understand Inflation and How It Affects You

- Federal Reserve: Federal Reserve officials kicked off 2023 by grappling with a thorny question: How should central bankers understand inflation after 18 months of repeatedly misjudging it?

- Social Security: The cost-of-living adjustment, which helps the benefit keep pace with inflation, is set for 8.7 percent in 2023. Here is what that means.

- Tax Rates: The I.R.S. has made inflation adjustments for 2023, which could push many people into a lower tax bracket and reduce tax bills.

- Your Paycheck: Inflation is taking a bigger and bigger bite out of your wallet. Now, it’s going to affect the size of your paycheck in 2023.

Even the reliable consumer-spending engine may be starting to sputter: Retail sales have fallen for two straight months, and Americans are increasingly turning to credit cards as pandemic-era savings dry up.

“The savings rate has continued to come down,” Mr. Bryson said. “Credit card debt continues to rise. Those trends — they’re not sustainable. It seems like consumers are continuing to run on borrowed time.”

Consumer spending, though solid, was weaker in the fourth quarter than forecasters expected, which may reflect a further slowdown — or even an outright decline — in the final months of the year. Half of the overall growth in the fourth quarter came from businesses building inventories, a sign that many companies may have sold less during the holiday season than foreseen.

But economists say a recession this year is not inevitable. Inflation has begun to ease in recent months, even as the unemployment rate has remained low. That could allow the Fed to raise rates more slowly, reducing the risk that it will go too far in cooling off the economy.

“We’ve seen good news on inflation even with the labor market staying strong,” said Wendy Edelberg, director of the Hamilton Project, an economic policy arm of the Brookings Institution. “Now monetary policy can be a little more patient.”